Minnesota Sales Tax Rate 2025

Minnesota Sales Tax Rate 2025. Use our calculator to determine your exact sales tax rate. The saint paul, minnesota sales tax is 7.88% , consisting of 6.88% minnesota state sales tax and 1.00% saint paul local sales taxes.the local sales tax consists of a 0.50% city.

Local sales tax rates might also apply depending on the location. Minnesota has state sales tax of.

The Use Tax Rate In Minnesota Is The Same As The General Sales Tax Rate, Which Is Currently 6.875%.

Sales tax applies to most retail sales of goods and some services in minnesota.

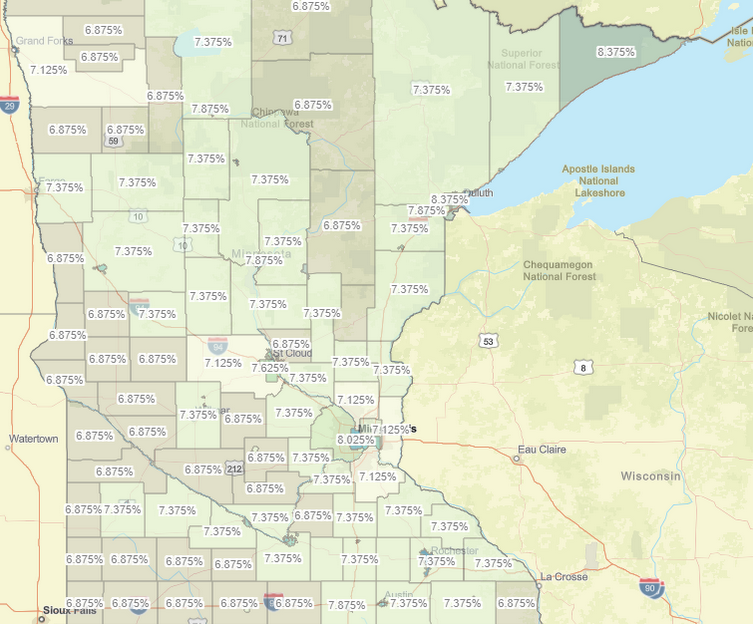

Minnesota Sales And Use Tax Rates In 2024 Range From 6.875% To 8.375% Depending On Location.

Tax rates are provided by avalara and updated monthly.

Minnesota Sales Tax Rate 2025 Images References :

Source: carlielindstrom.blogspot.com

Source: carlielindstrom.blogspot.com

south st paul mn sales tax rate Carlie Lindstrom, The saint paul, minnesota sales tax is 7.88% , consisting of 6.88% minnesota state sales tax and 1.00% saint paul local sales taxes.the local sales tax consists of a 0.50% city. Groceries and clothing are exempt from the chaska and minnesota state sales taxes.

Source: taxfoundation.org

Source: taxfoundation.org

State and Local Sales Tax Rates Sales Taxes Tax Foundation, Additional sales tax is then added on depending on location by local government. The saint paul, minnesota sales tax is 7.88% , consisting of 6.88% minnesota state sales tax and 1.00% saint paul local sales taxes.the local sales tax consists of a 0.50% city.

Source: carlielindstrom.blogspot.com

Source: carlielindstrom.blogspot.com

south st paul mn sales tax rate Carlie Lindstrom, Minnesota state sales tax rates. Below, we will highlight some of the basic provisions of minnesota sales tax law.

Source: www.anrok.com

Source: www.anrok.com

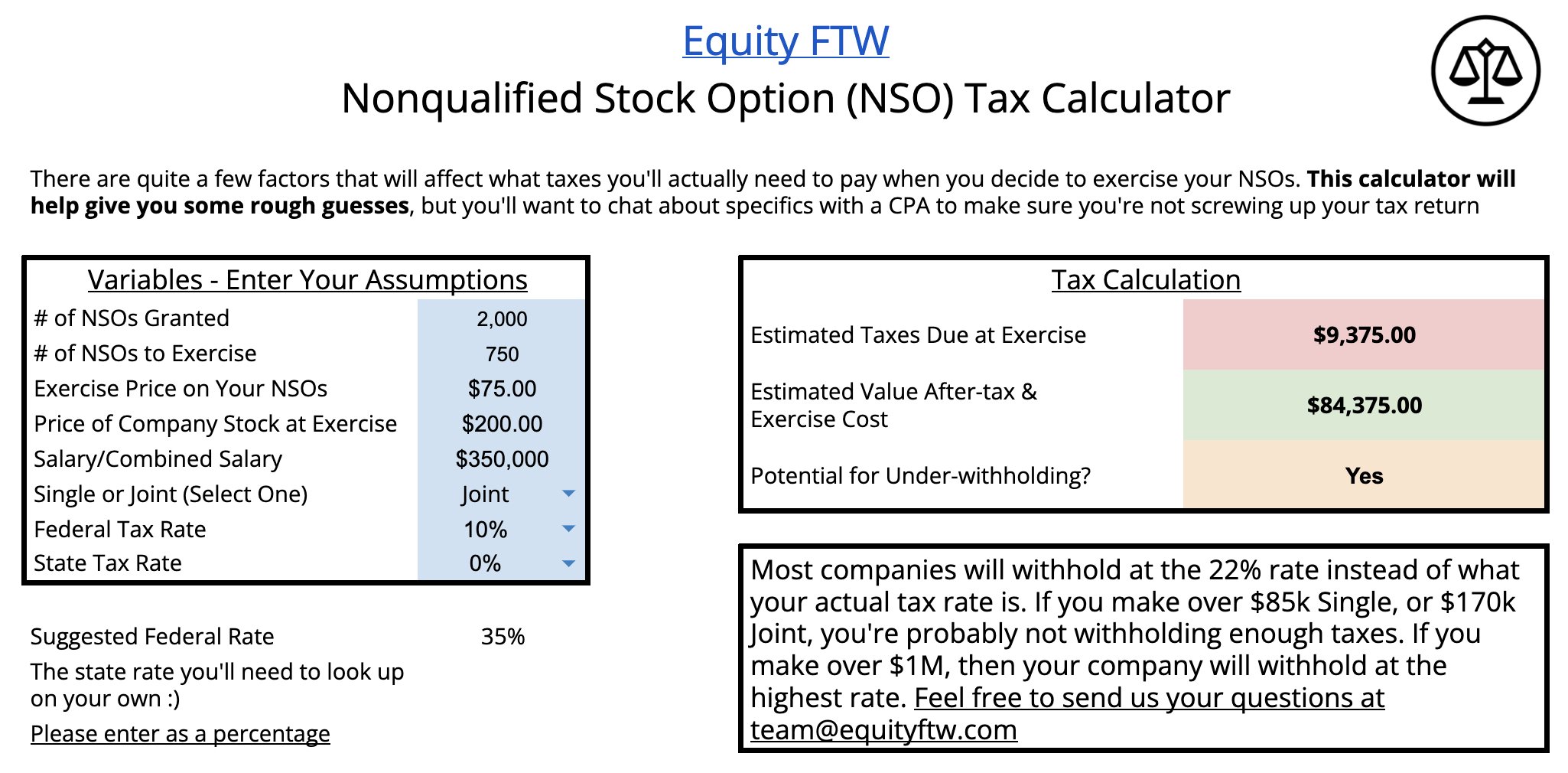

Is SaaS taxable in Minnesota? The SaaS sales tax index, The indexed brackets are adjusted by the. Sales and use tax summary statistics for cities, counties, and industries across minnesota.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

States without sales tax QuickBooks, Additional sales tax is then added on depending on location by local government. Below, we will highlight some of the basic provisions of minnesota sales tax law.

Source: www.salestaxsolutions.us

Source: www.salestaxsolutions.us

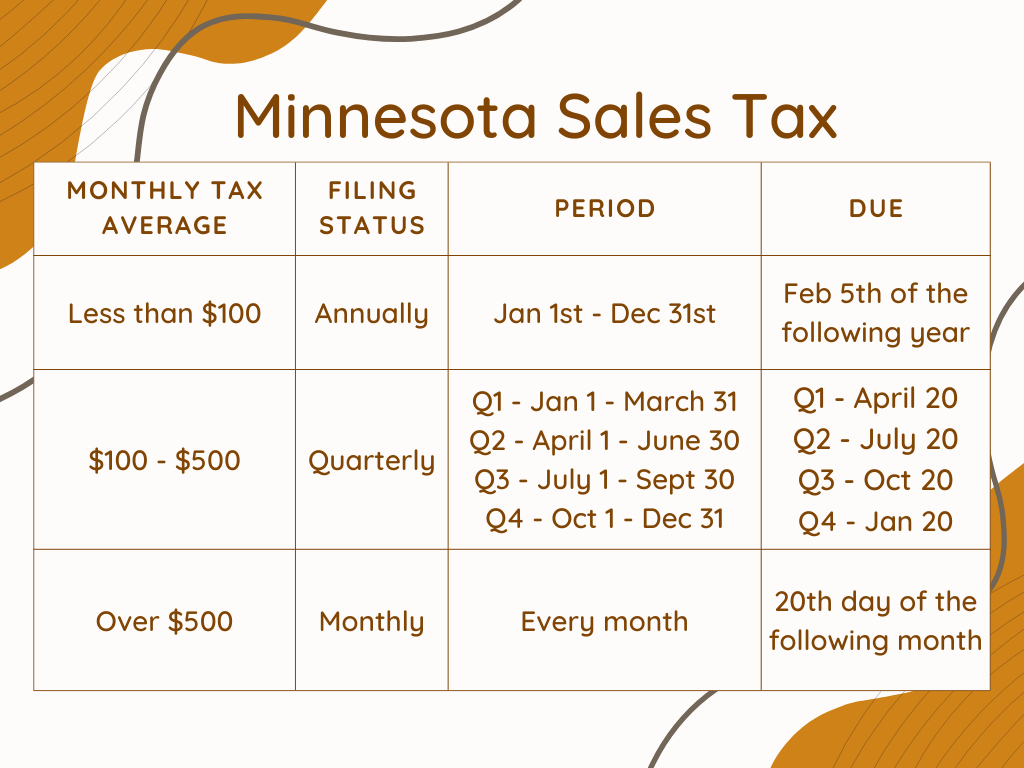

Sales Tax Minnesota Minnesota State Sales Tax Filing, The minnesota sales tax rate in 2023 is between 6.875% and 9.875%. Under state law, minnesota’s income tax brackets are recalculated each year based on the rate of inflation.

Source: lolaqjacinthe.pages.dev

Source: lolaqjacinthe.pages.dev

Minnesota Sales Tax Increase 2024 Manya Ruperta, Use our calculator to determine your exact sales tax rate. Below, we will highlight some of the basic provisions of minnesota sales tax law.

Source: www.americanexperiment.org

Source: www.americanexperiment.org

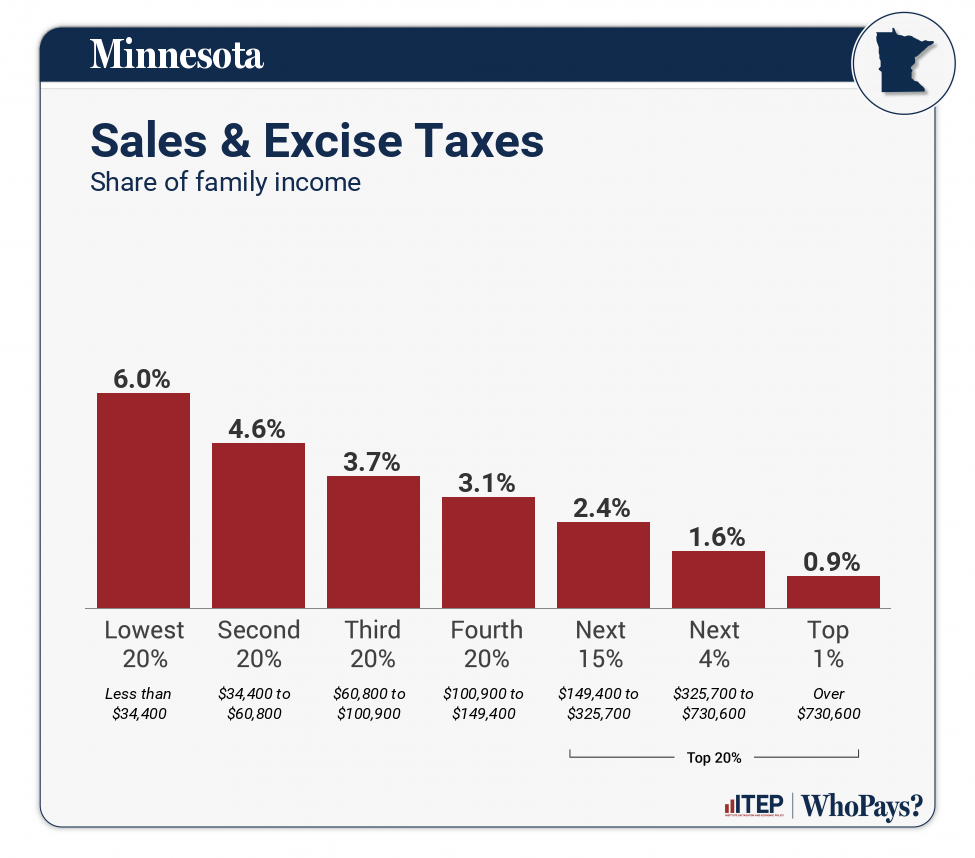

The Surplus Minnesota has some of the highest tax rates in the United, This comprises a base rate of 6.875% plus mandatory local rates up to 3%. Use our calculator to determine your exact sales tax rate.

+Tax+Calculator+Preview.jpg) Source: brockindrani.blogspot.com

Source: brockindrani.blogspot.com

6+ Sales Tax Calculator Minnesota BrockIndrani, The northfield, minnesota sales tax is 6.88% , the same as the minnesota state sales tax. To figure the sales tax rate, combine the state general tax rate (6.875%) and all applicable local tax rates (local taxes, special local taxes, and.

Source: itep.org

Source: itep.org

Minnesota Who Pays? 7th Edition ITEP, Look up 2024 sales tax rates for edina, minnesota, and surrounding areas. Minnesota sales and use tax rates in 2024 range from 6.875% to 8.375% depending on location.

Minnesota’s General Sales Tax Rate.

Sales tax applies to most retail sales of goods and some services in minnesota.

The Indexed Brackets Are Adjusted By The.

Minnesota sales and use tax rates in 2024 range from 6.875% to 8.375% depending on location.

Posted in 2025